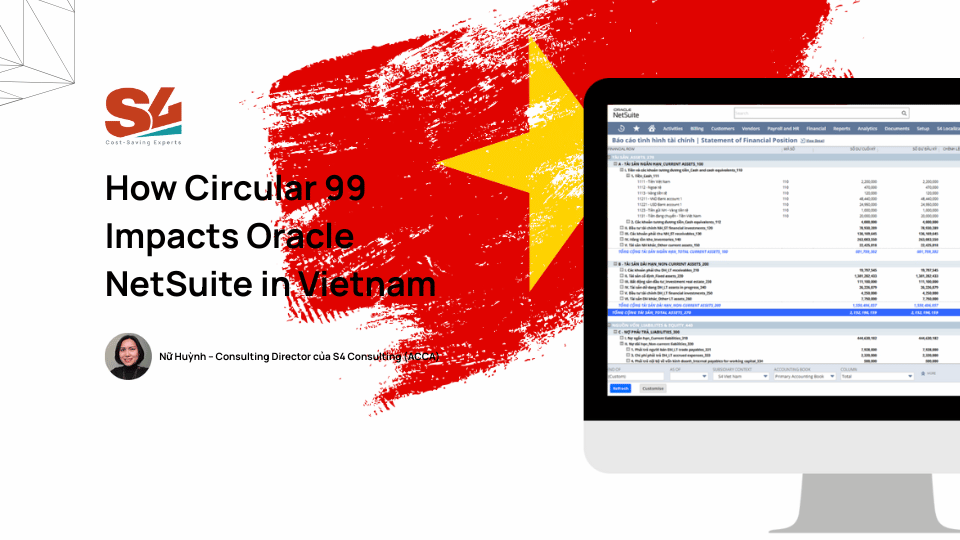

How Circular 99 Impacts Oracle NetSuite in Vietnam

Author: Nu Huynh – Consulting Director, S4 Consulting (ACCA Certified)

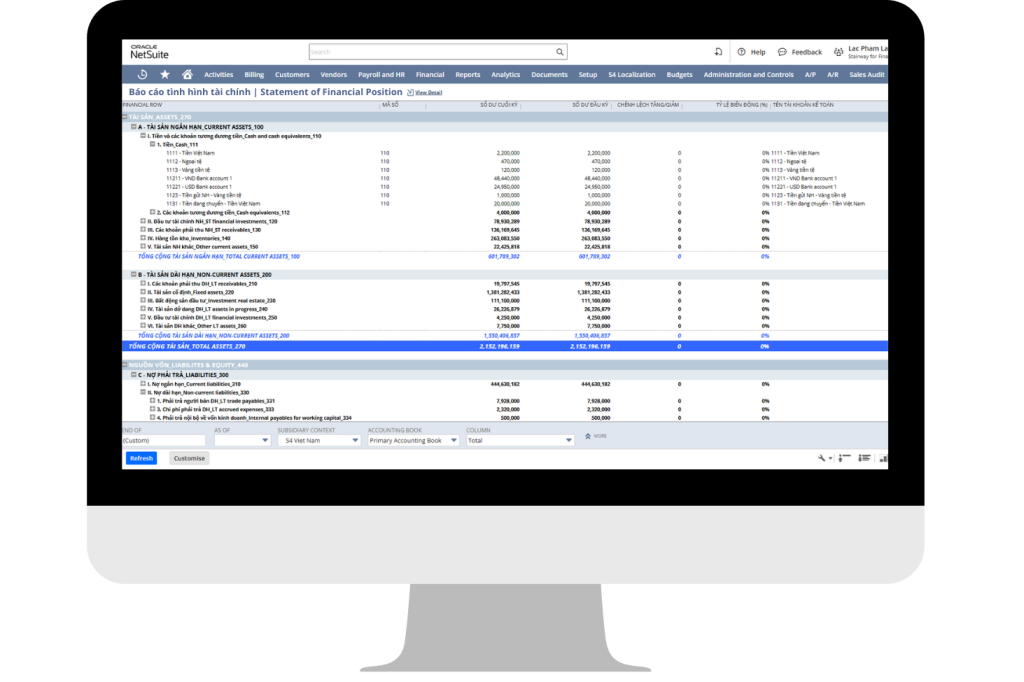

Transitioning from Circular 200 to Circular 99/2025/TT-BTC is not just an accounting change. For companies using Oracle NetSuite in Vietnam, it requires system reconfiguration, policy updates, and localization adjustments to ensure compliance without losing management-level visibility.

Below are the key workstreams that companies must address when adopting Circular 99 on NetSuite, based on real implementation experience in Vietnam.

1. What should companies prepare before applying Circular 99?

Companies must reassess their accounting policies and define a clear transition plan before making any system changes.

The first step is to identify material differences between Circular 200 and Circular 99, especially those that directly impact ERP configuration, such as revenue recognition principles, useful life of fixed assets, foreign currency accounting, and the level of autonomy in designing the chart of accounts.

Next, companies must issue a new Internal Accounting Policy. Circular 99 allows greater flexibility, but this flexibility is conditional on having formally approved internal policies. This document becomes the legal and operational foundation for customizing accounting structures in NetSuite.

Finally, a structured implementation plan is required, identifying which NetSuite modules must be adjusted, how existing data may be affected, and which teams will be involved.

More: The Regulatory Shift: From Circular 200 to Circular 99

2. How does the chart of accounts need to change under Circular 99?

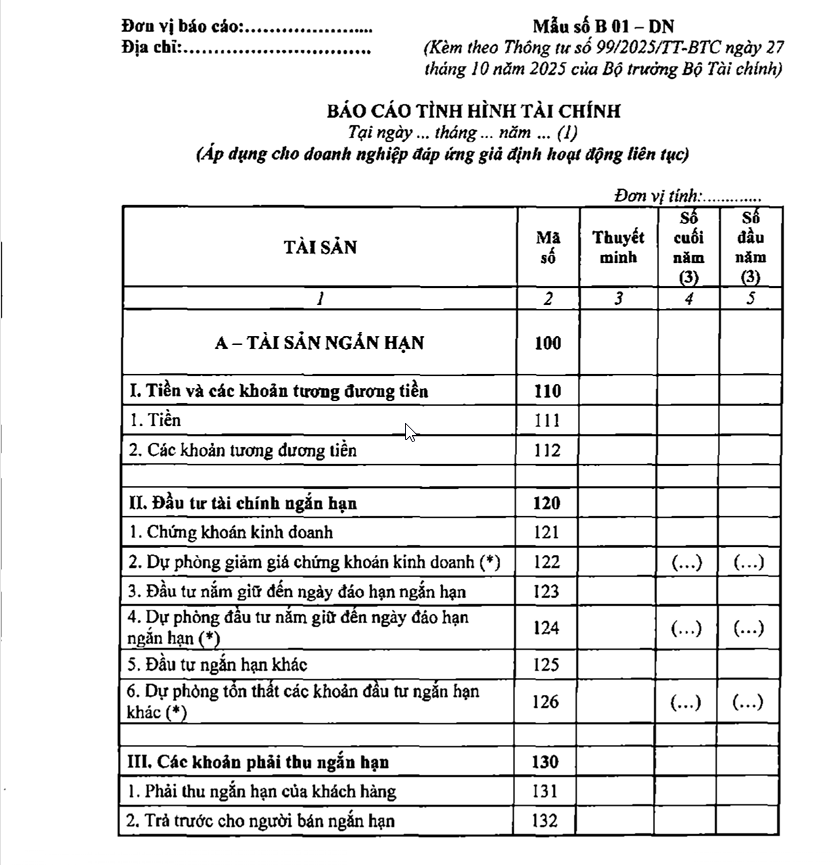

The chart of accounts (COA) is the most visibly impacted area when transitioning to Circular 99.

Companies need to review and update level-1 and level-2 accounts to align with the structure defined in Circular 99. On NetSuite, this typically involves adding, removing, or renaming existing accounts.

A critical difference is that Circular 99 allows companies to autonomously define level-3 and level-4 accounts. NetSuite supports this through sub-accounts and management segments, enabling both statutory and internal management reporting. However, the level of detail must be carefully designed to avoid unnecessary operational complexity.

3. What changes are required for fixed asset accounting on NetSuite?

Fixed asset accounting requires fundamental reconfiguration under Circular 99.

Unlike Circular 200, Circular 99 allows companies to define their own useful life for fixed assets. On NetSuite, this means reconfiguring the Fixed Assets Management module to support multiple depreciation rules based on internal policy rather than fixed regulatory frames.

In addition, the capitalization threshold for fixed assets must be updated, for example the commonly applied 30 million VND threshold, to ensure correct classification between fixed assets and tools or supplies. Incorrect configuration at this stage leads to long-term depreciation and cost allocation errors.

4. How should revenue recognition be handled to comply with Circular 99?

For complex sales transactions, Circular 99 aligns closely with IFRS 15 by applying the principle of control-based revenue recognition.

In practice, companies should use NetSuite’s Advanced Revenue Management to separate transactions into distinct performance obligations, such as products, installation services, or warranties. Transaction prices are allocated to each obligation, and revenue is recognized only when control is transferred.

Continuing to recognize revenue using legacy methods often results in significant mismatches between financial statements and actual operational performance.

5. Does foreign currency accounting need to be reconfigured on NetSuite?

Yes. Circular 99 requires foreign currency balances to be revalued at the end of each accounting period.

NetSuite must be configured to automatically run currency revaluation entries at month-end or quarter-end. This ensures that cash, receivables, payables, and other foreign currency balances reflect accurate values at reporting dates.

6. Does the NetSuite Vietnam localization package need to be updated?

Yes, and this step is frequently overlooked.

Although financial data is generated from NetSuite’s General Ledger, statutory financial statements must follow the formats and line items prescribed by Circular 99. This requires updating report templates and remapping GL accounts to financial statement indicators.

If a company is using a third-party Vietnam localization package, it is critical to confirm whether Circular 99 is supported, what updates are available, and under what commercial conditions.

7. What training and testing are required before going live?

Before officially applying Circular 99, accounting teams must be trained not only on NetSuite but also on the underlying accounting principles introduced by the new regulation.

More: Oracle NetSuite Financial Localization for Vietnam

At the same time, companies should perform testing in a sandbox or test environment to validate postings, depreciation, revenue recognition logic, and financial reports. This step significantly reduces the risk of errors when moving to live data.

8. What practical lessons come from real NetSuite projects in Vietnam?

In projects implemented by S4 Consulting, companies that succeed in transitioning to Circular 99 treat it as an opportunity to standardize and strengthen their financial architecture, not merely as a compliance exercise.

Projects that encounter issues often focus only on modifying reports, while leaving COA design, depreciation rules, and revenue recognition logic unchanged. These shortcuts typically lead to long-term data and reporting inconsistencies.

9. FAQ – Frequently Asked Questions

Do companies need to replace NetSuite to comply with Circular 99?

No. NetSuite fully supports Circular 99 requirements, but system configuration, accounting policies, and localization must be updated.

Can companies transition gradually from Circular 200 to Circular 99?

Yes, but the official application date must be clearly defined to avoid mixing accounting policies within the same period.

Can existing Vietnam localization packages still be used?

It depends on the provider. Companies should verify Circular 99 support and update timelines with their localization vendor.

Who should be involved in a Circular 99 transition project?

A successful transition requires close coordination between accounting teams, NetSuite consultants, and executive management.