How NetSuite Localization for Vietnam Works: COA Mapping & Multibook Accounting

NetSuite Localization for Vietnam: How to Stay VAS-Compliant While Using Your Parent COA

Global enterprises expanding into Vietnam face one recurring challenge: How can they comply with Vietnamese Accounting Standards (VAS) while still maintaining the same Chart of Accounts (COA) used by their parent company – typically under US GAAP, IFRS, or SFRS?

1. Vietnam’s Accounting Rules: Circular 200 and 133

In Vietnam, companies cannot freely design their own Chart of Accounts (COA).

The Ministry of Finance defines the COA structure through two main regulations:

| Circular | Applies to | Purpose |

|---|---|---|

| Circular 200 | Medium and large enterprises | Comprehensive accounting and reporting framework |

| Circular 133 | Small and medium enterprises | Simplified version of VAS |

All companies operating in Vietnam must:

- Use the account numbers and structure defined in these circulars.

- Prepare financial statements following the official VAS formats (Balance Sheet, Income Statement, etc.).

Therefore, multinational groups need a system that allows:

- Full compliance with Circular 200 or 133, and

- Consistent reporting with the parent company’s COA.

NetSuite’s Localization for Vietnam provides this flexibility through two main mechanisms:

(1) Multibook Accounting, and (2) Account Mapping (COA Translation).

2. Overview of the Two Mechanisms

| Approach | How It Works | Best For | Example |

|---|---|---|---|

| Multibook Accounting | Records each transaction in multiple general ledgers (books) simultaneously. | Large enterprises requiring strict audit and compliance. | One purchase recorded under both US GAAP and VAS. |

| Account Mapping | Records once under the parent COA, then automatically “translates” it into VAS format for reporting. | Companies seeking faster setup and lower cost. | “Raw Material” (parent COA) maps to “152 – Nguyên liệu, vật liệu” (VAS COA). |

3. Multibook Accounting – Parallel Ledgers

Concept

Multibook Accounting in NetSuite allows a single financial transaction to be automatically recorded in multiple general ledgers (“books”), each using its own accounting standard — such as VAS, IFRS, US GAAP, or Tax.

| Example Transaction | Book | Accounting Rule Applied |

|---|---|---|

| Purchase of office furniture | Primary Book: VAS | Recorded under “211 – Tangible Fixed Assets” per Circular 200 |

| Secondary Book 1: IFRS | Recorded as “Property, Plant & Equipment” under IFRS | |

| Secondary Book 2: Tax Book | Recorded according to Vietnamese tax depreciation rules |

Availability and Licensing

- Multibook Accounting is available only in the NetSuite OneWorld module.

It is not included by default. To use this feature, the customer or partner must raise a support ticket with Oracle NetSuite to enable Multibook functionality. - Customers using the NetSuite SuiteSuccess edition will not have Multibook Accounting included.

To activate it, an upgrade to OneWorld is required.

Once enabled, Multibook allows configuration of separate books for:

- VAS (Vietnam Local GAAP)

- IFRS

- Tax Reporting

- Parent GAAP (e.g., US GAAP or SFRS)

Example in Action

A manufacturing company records a purchase of a new production machine.

NetSuite automatically generates three sets of journal entries:

| Book | Account | Description |

|---|---|---|

| VAS Book | 211 – Tangible Fixed Assets | Recorded according to Circular 200 |

| IFRS Book | Property, Plant & Equipment | Recorded using IFRS depreciation method |

| Tax Book | TSCĐ – Khấu hao thuế | Recorded according to Vietnamese tax rules |

Result:

- Auditors can review each ledger separately.

- All reporting standards remain consistent.

- One transaction produces all required books automatically.

Advantages and Limitations

| Advantages | Limitations |

|---|---|

| Strong audit readiness | Requires NetSuite OneWorld module |

| Separate ledgers per accounting standard | Additional license and configuration effort |

| Full compliance for multi-standard reporting | Larger data volume and maintenance complexity |

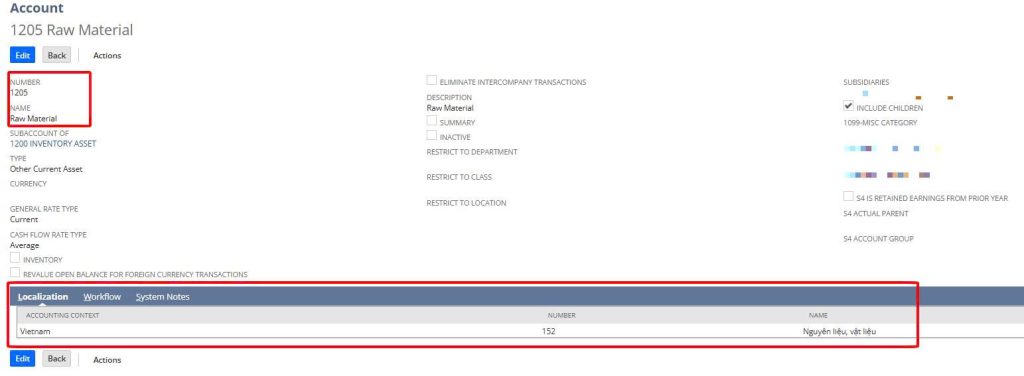

4. Account Mapping – Automatic COA Translation (Parent → VAS)

Concept

All transactions are entered once under the parent company’s COA.

NetSuite’s localization layer then automatically maps these accounts to their corresponding VAS-compliant accounts defined in Circular 200 or 133.

| COA Context | Account Number | Account Name | Based on |

|---|---|---|---|

| Parent Company COA | 1205 | Raw Material | US GAAP / IFRS |

| Vietnam (VAS COA) | 152 | Nguyên liệu, vật liệu | Circular 133 |

How It Works

| Step | Action | Description |

|---|---|---|

| 1 | Record transaction | The accountant enters transactions using the parent COA (e.g., “1205 – Raw Material”). |

| 2 | Apply mapping layer | The localization engine automatically applies the mapping rule (1205 → 152). |

| 3 | Generate local reports | Reports are formatted automatically according to Circular 200 or 133 (Balance Sheet, P&L). |

Example in Action:

A Vietnam subsidiary purchases raw materials.

- The accountant records the transaction under 1205 – Raw Material (parent COA).

- The localization layer maps it to 152 – Nguyên liệu, vật liệu (VAS COA).

- Reports generated for local authorities comply with VAS, while global consolidation remains seamless.

Advantages and Limitations

| Advantages | Limitations |

|---|---|

| Only one data entry required | Mapping setup requires local expertise |

| Complies with Circular 200/133 automatically | Mapping documentation needed for audit |

| No extra license cost | Slightly slower report generation if mapping tables are large |

5. Technical Comparison

| Feature | Multibook Accounting | Account Mapping |

|---|---|---|

| Transaction Entry | Recorded multiple times | Recorded once |

| Storage Volume | High | Low |

| VAS Compliance | Native per book | Achieved through mapping |

| Circular 200/133 Compatibility | Yes | Yes |

| Audit Readiness | Strong | Requires mapping documentation |

| Implementation Cost | Higher (OneWorld license + consulting) | Lower (custom mapping setup) |

| Ease for Users | Complex | Simple |

6. IFRS 2025 Transition in Vietnam

Vietnam plans to adopt IFRS starting in 2025.

NetSuite supports both methods for this transition:

| Method | IFRS Adaptation | Example |

|---|---|---|

| Multibook Accounting | Add an additional IFRS Book alongside VAS. | Record VAS + IFRS + Tax in separate books. |

| Account Mapping | Extend the mapping table (Parent → IFRS, Parent → VAS). | Map “1205 – Raw Material” → IFRS “PPE” → VAS “152”. |

7. Real-World Use Cases

| Company Type | Preferred Method | Reason | Example |

|---|---|---|---|

| Large manufacturing or listed corporations | Multibook Accounting | Strong audit control and multi-standard reporting | Group with subsidiaries in Vietnam and the US |

| Trading or service companies | Account Mapping | Lower cost and faster implementation | Technology service company with centralized reporting |

| Hybrid enterprises | Combination of both | Balance between accuracy and efficiency | Multibook for Fixed Assets, Mapping for Expenses |

8. Choosing the Right Approach

| If your priority is… | Choose |

|---|---|

| Full audit transparency and strict compliance | Multibook Accounting |

| Efficiency, simplicity, and lower cost | Account Mapping |

| Flexibility across standards | Hybrid approach |

Both approaches ensure:

- Full compliance with Vietnamese Accounting Standards (VAS)

- Seamless integration with the parent company’s COA

- Readiness for the IFRS 2025 transition