May Hoang Tung Streamlines Financial Reporting: S4 Consulting Translates US GAAP to Vietnam’s Circular 133

The Challenge: Reconciling Global Accounting Standards with Local Regulations

As the Vietnamese subsidiary of a US-based corporation, May Hoang Tung faced a dual challenge: they needed to use the Oracle NetSuite system already configured with their parent company’s US GAAP (Generally Accepted Accounting Principles), while also being strictly compliant with Vietnam’s Circular 133/2016/TT-BTC for preparing financial statements for local authorities.

The core issue lay in the fundamental differences between the two Chart of Accounts (COA). Rather than manually maintaining two separate systems, May Hoang Tung needed an intelligent solution that would allow them to operate on a single platform while satisfying both reporting requirements.

The Technical Solution: From Source Data to Translated Reports

To solve this problem, S4 Consulting implemented a core technical solution: a system that automatically translates and generates financial reports in compliance with Vietnamese standards based on data already recorded under the parent company’s COA.

The solution operates on a two-layer mechanism:

- Recording under the Parent Company’s COA: All of May Hoang Tung’s transactions are recorded directly in NetSuite using the accounts and segments pre-configured by the parent company. This ensures consistency and seamless global data synchronization from the outset.

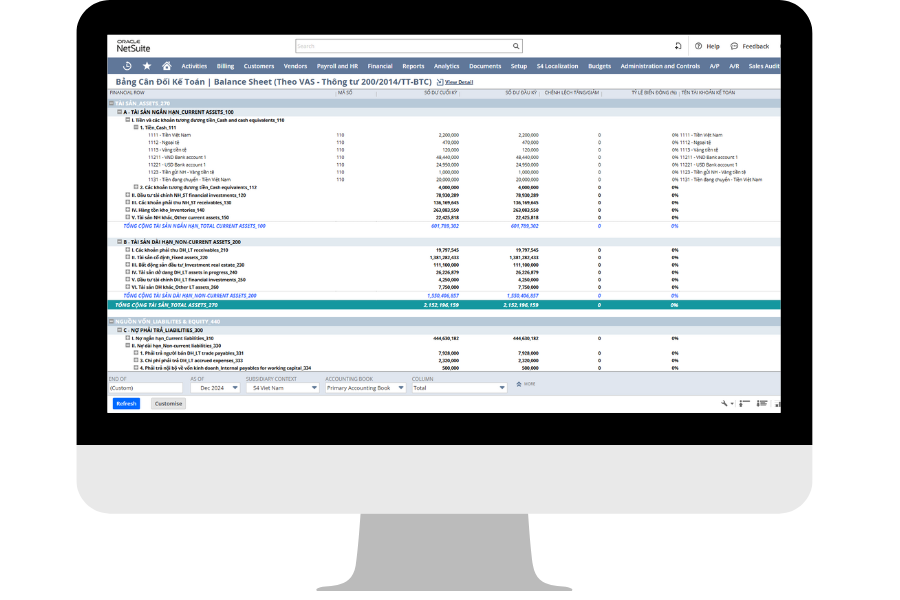

- Translating Reports for Vietnamese Compliance: When it’s time to generate reports for local authorities, S4 Consulting’s NetSuite Localization package comes into play. The system uses custom reports to automatically translate, summarize, and format the data into financial statements (such as the Balance Sheet and Income Statement) that perfectly match the templates of Circular 133.

For example: When purchasing an asset, a May Hoang Tung accountant records the transaction under the “Property, Plant & Equipment” account, as per the parent company’s configuration. However, when a period-end report is needed, the system automatically summarizes this data to accurately reflect it under the “Tangible Fixed Assets” category, as required by Circular 133.

Strategic Impact: Dual Compliance and Operational Efficiency

This unique solution provided significant benefits for May Hoang Tung:

- Time and Effort Savings: Accountants no longer need to manually enter data twice or create complex spreadsheets to reconcile the two systems.

- Reduced Risk: The solution ensures data consistency by using a single source of entry, minimizing errors associated with manual data handling.

- Dual Compliance: The company maintains seamless data synchronization with its global system while fully meeting all local financial reporting requirements.

This partnership demonstrates that with the right technical solution, a company can leverage the power of a global system while remaining flexible and compliant with specific local market demands, laying a strong foundation for sustainable growth.

FAQs about the Solution

1. Does this solution apply to other Vietnamese accounting standards (such as Circular 200)? Yes, it does. S4 Consulting’s solution is built on a flexible and customizable platform that can be adapted for both Circular 133 (for small and medium-sized enterprises) and Circular 200 (for larger enterprises).

2. What are the main benefits of this solution for the US-based parent company? The solution ensures that the parent company receives accurate and automated financial data from its Vietnamese subsidiary, eliminating the need for manual data entry. This optimizes the consolidation process, improves transparency, and supports faster decision-making.

3. Does this solution help May Hoang Tung comply with Vietnam’s e-invoicing regulations? Yes. S4 Consulting’s localization package includes a feature that integrates NetSuite with e-invoicing providers in Vietnam, ensuring compliance with current tax regulations.