NetSuite Localization for Vietnam: What You Need to Know for Success

NetSuite Localization for Vietnam is no longer just about compliance with the traditional Circular 200; it is about future-proofing your business for the upcoming regulatory shift. As Vietnam prepares to transition from Circular 200 (TT200) to the new General Accounting Regime (referred to as Circular 99), businesses must adopt a localized ERP strategy that ensures compliance with current laws while embracing the flexibility and IFRS-convergence of the new standards.

This article explores the key requirements for NetSuite localization in this transitional period, the gaps in standard functionality, and best practices for success.

The Regulatory Shift: From Circular 200 to Circular 99

Understanding the Legacy: Circular 200 (TT200)

For years, Circular 200 has been the backbone of Vietnamese Accounting Standards (VAS). It is characterized by:

- Rigidity: A mandatory, uniform Chart of Accounts (COA) and strict financial report templates.

- Form over Substance: Heavy emphasis on legal form and detailed government reporting templates.

- Historical Cost: Assets are largely valued at historical cost, with minimal room for fair value accounting.

The Future: Circular 99 (The New General Accounting Regime)

The Ministry of Finance is finalizing Circular 99, intended to replace Circular 200. This new regime aims to modernize Vietnamese accounting and align it closer to international practices. Key anticipated changes include:

- Increased Flexibility: Businesses may be empowered to design their own Chart of Accounts (COA) based on operational needs, provided they map to statutory requirements.

- Alignment with IFRS: A shift toward “substance over form” and the introduction of Fair Value principles for certain assets and liabilities.

- Simplified Reporting: A potential reduction in the complexity of mandatory statutory reports, focusing more on the quality of information.

Key Differences: VAS (TT200/TT99) vs. IFRS

While the gap is narrowing with Circular 99, significant differences remain. A successful NetSuite implementation must handle the “Hybrid” nature of this transition period.

1. Financial Reporting and Chart of Accounts

| Criteria | IFRS | VAS (TT200) | VAS (Draft TT99) |

| Chart of Accounts (COA) | Flexible; companies design their own structure. | Strictly Mandatory standard COA under Circular 200. | Flexible. Companies can design COA but must map to the prescribed financial statement items. |

| Reporting Currency | Functional currency based on economic environment. | Default is VND. Foreign currency must be converted for statutory reporting. | Remains VND for statutory reports, but clearer guidance on functional currency is expected. |

| Presentation | Principle-based presentation. | Strict adherence to specific government forms. | Likely to allow more judgment in presentation, moving closer to IFRS principles. |

2. Fixed Assets and Valuation

| Criteria | IFRS | VAS (Current & Transition) |

| Asset Recognition | Based on control and future economic benefits (no minimum value). | Currently requires a minimum cost (e.g., VND 30 million). Under TT99, this threshold may be updated or left to enterprise judgment. |

| Valuation Model | Choice between Historical Cost or Fair Value. | Historical Cost is dominant. However, TT99 is expected to introduce Fair Value measurements for financial instruments and specific assets, narrowing the gap with IFRS. |

3. Revenue Recognition

| Criteria | IFRS (IFRS 15) | VAS (TT200 -> TT99) |

| Approach | 5-step model based on transfer of control and performance obligations. | TT200: Risks and rewards transfer / Invoice issuance. TT99: Expected to move closer to the “transfer of control” principle, reducing the discrepancy with IFRS 15. |

Key Requirements for a Future-Ready NetSuite Localization

A successful NetSuite Localization must now serve two masters: the strict compliance of TT200 (for now) and the flexible, IFRS-oriented architecture of TT99 (for the future).

1. Agile Chart of Accounts (COA)

The system must support a Global COA (for IFRS/Management) while maintaining a mapping engine to populate Vietnamese statutory reports. With TT99 allowing COA design flexibility, the “Hard-coded COA” approach of the past is becoming obsolete.

2. Advanced Tax Localization

- E-Invoicing Integration: Seamless connection with local e-invoice providers (Viettel, VNPT, BKAV).

- VAT & CIT Compliance: Automated VAT calculation (Declaration 01/GTGT) and CIT provision tracking.

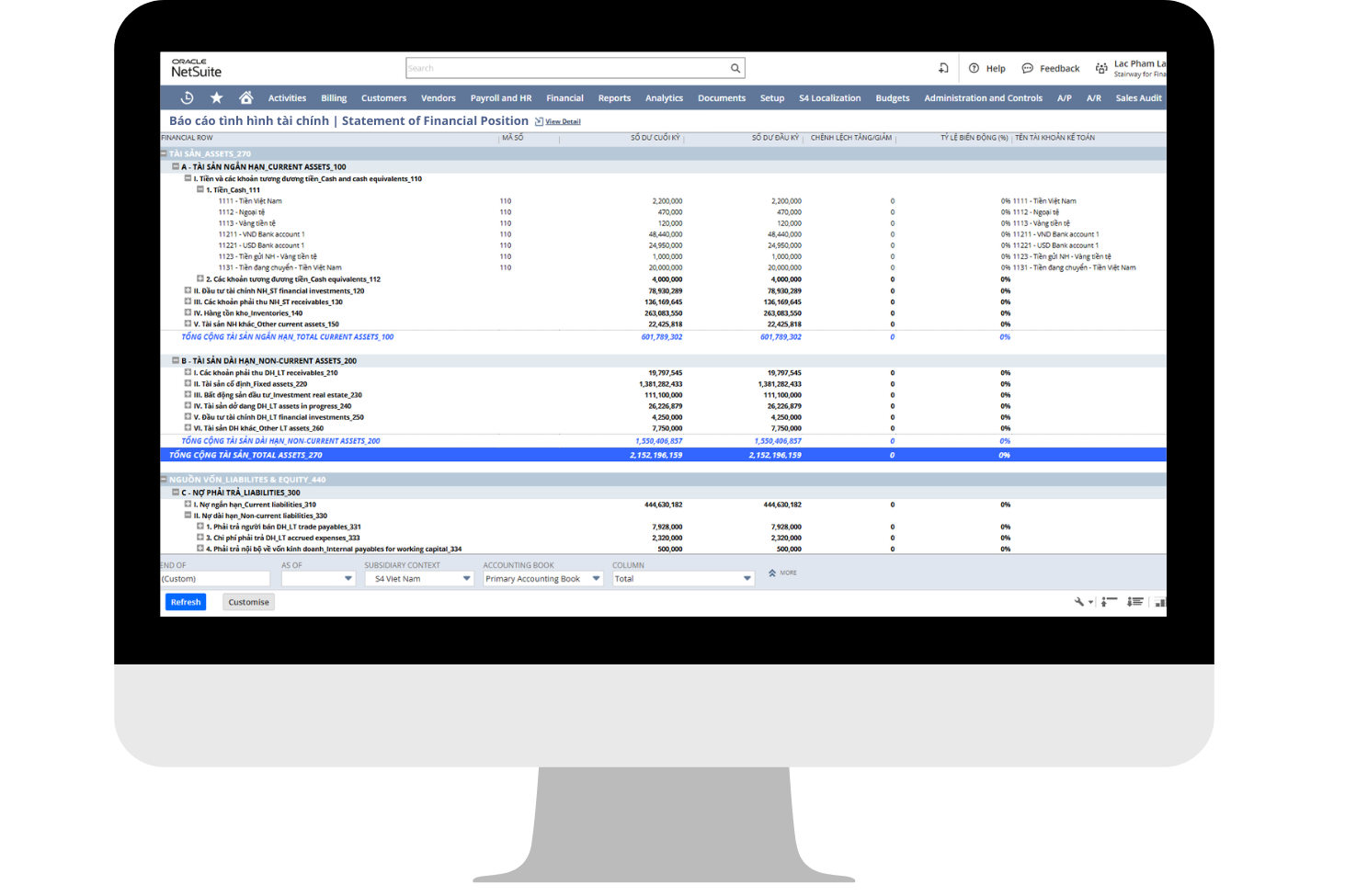

3. Comprehensive Statutory Reporting

The solution must generate the following, with the ability to update templates as TT99 is rolled out:

- Balance Sheet (Bảng Cân Đối Kế Toán)

- Income Statement (Báo Cáo Kết Quả Hoạt Động Kinh Doanh)

- Cash Flow Statement (Báo Cáo Lưu Chuyển Tiền Tệ)

- Detailed Ledgers: General Journal, Ledger, and Receivables/Payables details (Sổ Nhật Ký Chung, Sổ Cái, Sổ Chi Tiết).

4. Multi-Book Accounting (The Gold Standard)

With TT99 introducing Fair Value and distinct principles, NetSuite Multi-Book Accounting is essential.

- Primary Book: Records transactions for Management/IFRS.

- Secondary Book: Automatically posts adjustments for VAS compliance (e.g., FX rates, revenue recognition timing, disallowed expenses).

Two Approaches to Localization: Why “Native” Wins with TT99

As Vietnam moves toward TT99 (more flexibility), the localization methodology becomes critical.

Stop wasting money – Cut Oracle NetSuite project costs by up to 50%

Approach A: Using NetSuite Native Report Builder (Recommended for TT99)

- How it works: Leverages NetSuite’s built-in financial report writer customized for Vietnam.

- Why it suits TT99:

- Flexibility: As TT99 allows companies to modify their COA, Native Report Builder allows finance teams to drag-and-drop and re-map accounts without coding.

- Drill-Down: Users can click from the VAS Balance Sheet directly into transaction details—crucial for auditing under the new regime.

- Single Source of Truth: Unifies management and statutory data.

Approach B: Using Hard-Coded Suitelets

- How it works: Scripts generate a static HTML/PDF file that looks exactly like the government form.

- The Risk: While this ensures “pixel-perfect” TT200 compliance, it is rigid. When TT99 changes the reporting structure or allows new line items, these scripts require expensive redevelopment. This approach lacks the agility needed for the coming transition.

Key Factors for Success

Successfully navigating the shift from TT200 to TT99 requires:

- Expert Consultation: Partners who understand the trajectory of Vietnamese accounting, not just the current rules.

- Change Management: Preparing the accounting team to move from “filling forms” (TT200) to “interpreting standards” (TT99/IFRS).

- Scalable Technology: Avoiding hard-coded solutions that break when regulations change.

S4 Consulting’s Future-Ready Localization Bundle

S4 Consulting has developed a NetSuite Localization for Vietnam designed for the transition era. By adopting Approach A (Native Report Builder), S4 ensures that your system is not only compliant with the current Circular 200 but is fully adaptable to the flexible nature of Circular 99.

Why choose S4 Consulting?

- Compliance & Agility: Pre-built reports that align with TT200 but can be easily reconfigured for TT99 changes by your internal team.

- IFRS Convergence: Our solution supports Multi-book accounting, allowing parallel reporting of IFRS and VAS effortlessly.

- Drill-Down Power: We empower Chief Accountants to audit data directly from statutory reports, a feature hard-coded solutions lack.

- Automated Mapping: Smart engines that map your global COA to local statutory requirements instantly.

Prepare your business for the future of Vietnamese accounting with S4 Consulting.

Dưới đây là phần Frequently Asked Questions (FAQ) được soạn thảo bổ sung vào cuối bài viết. Nội dung này tập trung giải quyết các thắc mắc thực tế của các CFO/Giám đốc tài chính nước ngoài khi triển khai NetSuite tại Việt Nam, đồng thời củng cố các điểm mới về Thông tư 99 (Circular 99) và giải pháp của bạn.

Frequently Asked Questions (FAQ)

1. Is NetSuite officially certified by the Vietnamese government? Foreign ERP systems like NetSuite do not receive a specific “certification” from the Ministry of Finance. However, the requirement is on the output, not the software itself. As long as the system produces financial reports, vouchers, and tax declarations that adhere to the format prescribed by Circular 99 (General Accounting Regime), it is fully compliant. S4 Consulting’s localization bundle ensures your NetSuite outputs meet these strict legal standards.

2. Can we use our Global Chart of Accounts (COA) for the Vietnam subsidiary? Yes. Under the new General Accounting Regime (Circular 99), businesses have more flexibility to design their own COA compared to the older regulations. You can implement your Global COA in Vietnam, provided that you set up a mapping structure to aggregate these accounts into the statutory line items required for local reporting (e.g., the Statement of Financial Position). Our solution handles this mapping automatically.

3. Do we need to maintain two separate sets of books for Vietnam? Typically, yes. Because there are still differences between VAS (Local Compliance) and IFRS/US GAAP (Headquarters Reporting)—such as revenue recognition timing and fixed asset depreciation rules—most companies use NetSuite Multi-Book Accounting. This allows you to have a primary book for corporate reporting and a secondary book that automatically adjusts for Vietnam’s statutory requirements.

4. How does NetSuite handle Vietnam’s mandatory E-Invoicing? Vietnam mandates the use of Electronic Invoices (E-invoices) with a specific XML format validated by the Tax Authority. NetSuite does not generate these XMLs natively. Instead, the standard practice is to integrate NetSuite with a local E-invoice provider (such as VNPT, Viettel, or BKAV). When you create an invoice in NetSuite, the data is automatically pushed to the local provider to issue the legal E-invoice instantly.

5. Why is the “Balance Sheet” now referred to as the “Statement of Financial Position”? This change is part of Vietnam’s transition to the new General Accounting Regime (Circular 99). The Ministry of Finance has updated terminology to align closer with international standards (IFRS). While the name has changed, the report still serves the same fundamental purpose, though the structure and presentation rules have been updated.

6. Why do you recommend “Approach A” (Report Builder) over hard-coded custom reports? Hard-coded reports (Approach B) are static and difficult to change. With the regulatory environment in Vietnam shifting towards Circular 99, requirements may evolve. Approach A uses NetSuite’s native tools, allowing for drill-down analysis (auditable data) and easier adjustments if the government updates report templates in the future. It offers a balance of compliance and long-term agility.